The success and satisfaction of your employees largely hinges on your team’s ability to provide them with the tools and equipment they need, quickly.

To help you tackle this at scale, you can turn to procure-to-pay automation. This type of finance automation not only benefits the employees who submit the requests, but it also helps your team manage each and every request with little work and complete accuracy.

We’ll walk you through how procure-to-pay works, where automation can improve the process, and the benefits from leveraging automation. But to start, let’s align on what procure-to-pay automation is.

Note: Procure-to-pay automation can come in a variety of alternative names. These include p2p automation, purchase-to-pay automation, and procure-to-pay process automation.

What is procure-to-pay automation?

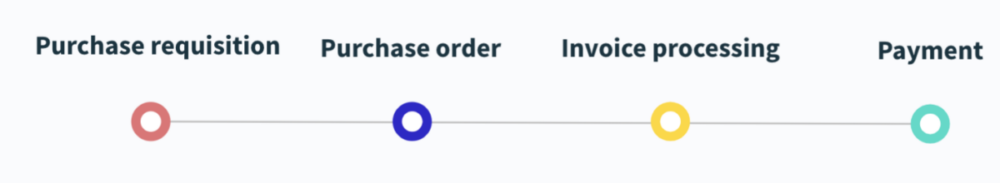

It’s the use of automation to streamline your procure-to-pay process from beginning (purchase requisition) to end (paying off invoice).

To implement procure-to-pay automation, you’ll need a platform that can connect all of the relevant applications, and use triggers (or business events) that lead to actions (or real-time business outcomes). The next section highlights how these triggers and actions can work.

Related: What is automated invoicing?

How the procure-to-pay process works

To understand where automation fits into the workflow, it’s worth remembering how, exactly, the process works.

Here’s a quick refresher on each of the steps.

1. Purchase requisition: A requestor fills out an internal document—typically provided by their department—that highlights everything about their request. This includes details like the vendor they’re looking to buy from, the specific plan or items they’re looking to purchase, the total cost of their request, etc.

2. Purchase order: Once approved, the purchase order (PO) gets created by the organization’s ERP system and gets sent over to the vendor.

3. Invoice processing: As the vendor delivers their order, they’ll also provide the invoice. To process it, the accounts payable (AP) team will follow a standard approach to verify its accuracy before officially approving and signing off on it. This likely includes classifying the invoice based on specific categories as well as matching it against the PO.

4. Payment: Finally, once the invoice is approved, the payment goes out to the vendor.

Each of these steps are time consuming, as they call for a significant amount of data entry and app hopping. But by turning to purchase-to-pay automation, you can streamline much of the process on behalf of your team.

How to automate your procure-to-pay process

An end-to-end purchase-to-pay automation requires 4 trigger-based workflows:

Note: You can only build these workflows once you’ve used an enterprise automation platform to connect the relevant systems, such as your ERP, the supplier’s ERP, and your spend management tool.

1. Once the purchase order in the spend management tool gets created, it (along with other relevant info) automatically gets added to your ERP as well as the supplier’s.

2. After the item is marked as received in the spend management tool, the receipt-based information also gets added to the ERP.

3. When the invoice gets created in the supplier’s ERP, the invoice instantly gets created in yours.

4. Once the invoice payment is made in your ERP, the purchase order in the spend management tool gets closed.

Here’s the entire workflow in action, assuming you use NetSuite as your ERP and Coupa Software for managing spend, while your supplier uses Quick Base as their ERP:

In addition to the example above, you can make the procurement process easier on employees by leveraging other automations. Here are just some examples:

Procure role-specific equipment for each incoming hire

As new hires begin working at your company, they may realize that they don’t have all of the equipment that’s needed to perform their day-to-day tasks.

You can get ahead of this by connecting your HRIS with your procurement tool and then implementing the following workflow: Once the new hire is marked as hired in your HRIS, purchase orders get created on their behalf—which includes the predetermined equipment that’s based on their role.

Allow employees to make ad-hoc requests with ease

Your longer-tenured employees may need new equipment and devices over time as their roles evolve or as their company-owned assets worsen. Moreover, they might simply be eligible to procure certain equipment and devices based on your company’s policies.

Whatever the case might be, you can help your employees submit procurement requests more easily by integrating your procurement tool with your business communications platform. From the former, your employees can then make requests while the appropriate approvers can review and accept (or reject) them—all in a matter of clicks.

Send automated reminders to ensure that orders move along efficiently

There’s little that’s more frustrating for employees and vendors than a PO moving towards completion at snail’s pace. This poor contract management keeps employees from having the resources they need to be at their most productive, and it gives your organization a bad reputation in the eyes of vendors—hurting your ability to work with them long term.

To ensure that each PO gets reviewed and approved quickly, you can sync your business comms platform with your procurement tool and implement a workflow automation that works as follows: Once a PO isn’t approved by a specific employee for a given length of time, they’ll receive a direct message in the business communications platform that reminds them to review it.

Why is procure-to-pay automation important?

You probably have a solid grasp of the benefits procurement automation provides just from reading the previous section. Here’s a broad list in case you miss any.

- It enables employees to get what they need, quickly. This should go a long way in boosting their productivity and satisfaction.

- It prevents mistakes by your team. If performed manually, your team is more prone to making errors (e.g. mistaking the item an employee requests).

- It offers a scalable solution. As your organization grows, so too will procurement requests. Purchase-to-pay automation allows you to accommodate significantly more requests while marginally increasing the time you and your colleagues need to invest.

- It improves vendor relationships. This streamlined approach allows your finance team to more easily pay vendors on time and in the correct amount.

- It saves your team a significant amount of time. You and your colleagues can use your newfound time to focus on other business-critical, strategic initiatives instead.

- It provides a significant amount of cost savings. By receiving and paying invoices on time, your team can not only avoid penalties related to making late payments, but also potentially benefit from early payment discounts.

These benefits, along with many others, aren’t lost on the teams that play a role in building their organizations’ p2p automations.

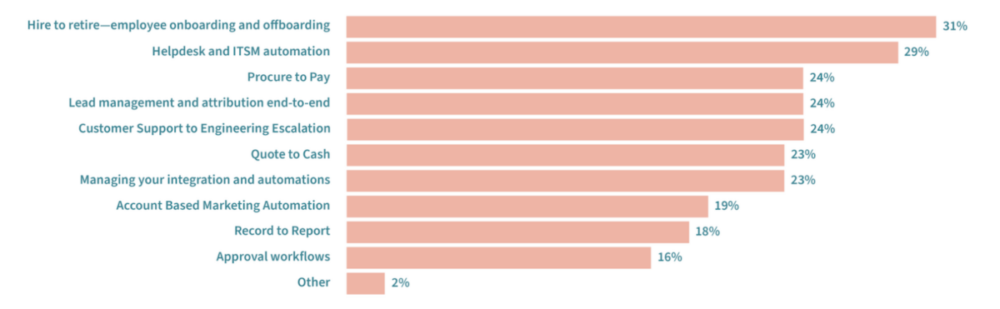

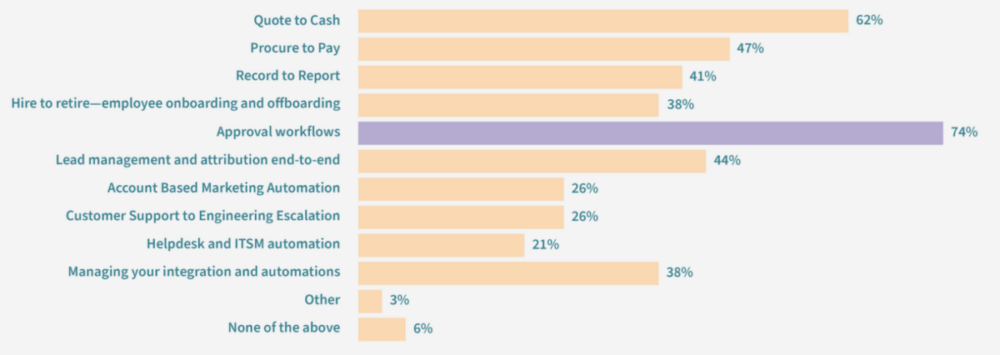

When we surveyed business technology professionals earlier this year, we found that procure to pay was high on their list of desired automations as well as one that many have already built.

BT professionals ranked it as their 3rd most desired automation:

And it was the 2nd most popular automation to build:

Learn more about the automations that BT professionals and lines of business are prioritizing by downloading our State of Business Technology.

What you need from your purchase-to-pay automation tool

Once you and your team are set on automating your p2p process, the next question involves deciding which tool you use to implement the automations.

Here’s some questions that can help guide you in your decision:

1. Does the tool allow you to make use of automation triggers?

This allows you to kickstart workflows only once certain predefined events take place in your apps. Once they have, the tool can kickstart a set of actions across your apps, data, and teams in real-time (which is paramount in ensuring that your workflows operate smoothly).

2. Does the tool provide pre-built connectors and automation templates (also known as “recipes”)?

Being able to access pre-built connectors and automations can help your team implement integrations and automations faster and more easily. That said, you can make changes to any automation template so that it meets the needs of your procure-to-pay workflow.

3. Does the tool offer accessibility for employees with a non-technical background?

Though your employees in IT may end up implementing and maintaining the integrations and automations, employees in accounts payable likely want to play a role in its execution.

Using a low-code/no-code platform, employees in AP can more easily review the workflows your team builds and provide feedback on them, all but ensuring that your p2p process operates at its full potential.

Ready to automate your p2p process?

Workato, the leader in integration-led automation, addresses all of the questions above and allows you to implement the example highlighted earlier.

To learn more about how the platform works and how it can serve as the procure-to-pay solution your business needs, you can speak with one of our automation experts.