Paysafe (formerly iPayment, Inc.) is a leading provider of payment processing solutions for small to midsize businesses. Serving more than 137,000 customers, they provide everything needed to get a business started and run it smoothly, including payment acceptance terminals, point-of-sale solutions, gateways for online transactions and more.

When Deidre Jones, who is the Manager of Service Applications and Technology, joined the team, Paysafe’s CIO had implemented Zendesk across the company’s support center to provide better reporting and auditing. The company also uses a custom CRM, DocuSign for contracts, and Salesforce for direct sales, business development, and partner account management.

Paysafe has several different support departments that work with different parts of the business. A few have their own instance of Zendesk and their own business processes.

“Some of our processes are limited due to lack of integration with our custom CRM,” explains Jones. Jones was tasked with improving connectivity in the Customer Support department and made it a major objective for the year.

Finding a Platform for Both Powerful Point-to-Point Zendesk Integration and Workflow Automation

It can be difficult and slow to implement new processes into a long-existing protocol. So, when the company decided to launch a new business unit (then known as iPayment Capital) that originates and services merchant cash advances, Jones took the opportunity to find an integration platform that could both make this process run smoothly, and integrate the existing integration gaps down the line.

In addition to functionality and ability to scale, Jones needed a platform that could do more than point to point integration. She knew Paysafe’s competitive advantage was to offer these cash advances quickly, but in order to do that, they needed to intelligently automate processes between Salesforce, Zendesk, and DocuSign to decrease manual work and waiting times for responses.

Paysafe needed an integration and automation platform that they could speedily deploy and that could securely handle a robust integration between Salesforce and Zendesk without creating duplicates or errors, and they chose Workato.

Creating Agile Workflows For a New Project with Salesforce, Zendesk, and DocuSign

One function of this new unit is approving merchant cash advances. Granting advances to new businesses means protecting the customer’s financial information. To do this, Paysafe sales reps who worked out of Salesforce do not have access to Zendesk where the customer service agents work. This created a silo between the two apps and teams, who need to share certain information as well as creating waiting periods to get said information.

Using Workato, Paysafe created a contract deployment workflow triggering from Salesforce and deploying a DocuSign contract. They also have a bi-directional Zendesk integration with Salesforce so both sales and iPayment underwriting agents always have the information they need in their respective systems. The Workato recipe (recipes are what we call our integrations and automations) is triggered when a new document is completed in DocuSign and creates a new Zendesk ticket. Workato also automatically syncs anything that happens in Zendesk to Salesforce and vice versa.

Automated Contract Deployment and Collection from Salesforce to DocuSign and Synced Back to Zendesk

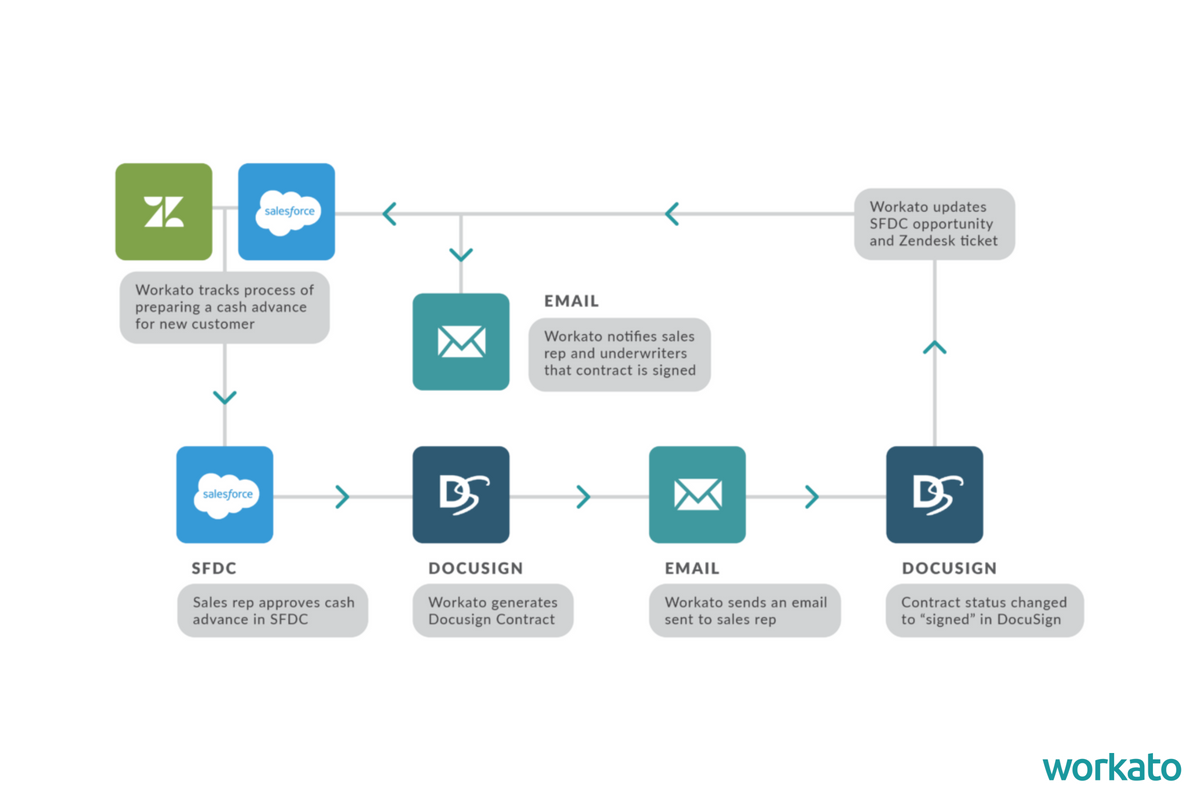

Paysafe uses Workato to orchestrate the contract deployment and collection process to decrease wait times. When a new business is interested in a merchant cash advance, several underwriters perform a series of checks like background checks, credit history etc. Workato tracks this process in both Zendesk and Salesforce, noting the name of the underwriter and populating other fields in the Zendesk ticket.

Once the sales rep gets the go-ahead, they use a button inside of Salesforce to initiate Workato’s immediate generation of a contract in DocuSign with the updated contract terms and sends an email to the sales rep. This changes the status of the doc to “signed” in DocuSign, which triggers a Workato recipe to update the Salesforce Opportunity status and the Zendesk status.

Another Workato recipe waits for the document to come back signed, then updates the opportunity in Salesforce, and also the ticket in Zendesk, attaching the contract to the ticket. Workato also changes the status of the credit approval to reflect the successful contract signing.

“Once Workato notes that the contract has been signed in Zendesk and Salesforce, the workflow continues, notifying the sales rep and the underwriters that the contract has been signed. As the process continues, Workato is actually updating Zendesk and Salesforce to keep the statuses synced,” explains Jones. “We have several Workato integrations between Zendesk, Salesforce, and DocuSign, and using Workato has greatly improved that process.”

Choosing Workato for Agile and Secure Zendesk Integration

When offering merchant cash advances, speed is incredibly important. Jones explains:

“The quicker we can move, the better. Some merchants would like to complete the process in as little as a day. Workato allows us to move more quickly and in a more continuous way without stopping to wait for materials. Because Workato is updating Zendesk tickets and Salesforce, and sending notifications, the agents, underwriters, and reps are all able to collaborate on the same ticket without too much time passing.”

“With Workato automating our workflow and reducing wait times, we are able to offer funding in as little as 1 day, versus going through a bank where it can possibly take months to get funded.” The other big win with Workato was finding a tool that met their security standards. “Our web portal team, iAccess, is very careful about the technologies we can implement,” said Jones. “Workato was a big step. We are excited about our future plans with both Workato and Zendesk.”

Scaling with Workato and Zendesk

For Jones and the Paysafe team, speed and agility are the ultimate measures of success – something that Workato has enabled. “Paysafe Capital started in August and we went live with the department in October. Workato allowed us to move quickly, and get it built out in time for our launch. It was such an aggressive timeline and Workato really helped us meet it,” said Jones.

Jones also needed a tool that could scale with Paysafe’s future projects with Zendesk and Salesforce. “We’re still doing more releases. We have a new release coming up this month for our renewal process and part of my work on that is going to be building two new Workato recipes to process renewal applications. Workato has definitely been a benefit in our iPayment Capital Zendesk instance,” said Jones. “I’m looking to set up more integrations in our other instances of iPayment also.”

Zendesk Integration: Selective Comment Sync from Zendesk to Salesforce

Paysafe also wants to create a selective bi-directional sync of comments between Zendesk and Salesforce so users can collaborate in the comments via either app. That means, when a support agent comments on a Zendesk ticket, the comment will also sync to the corresponding Salesforce opportunity. However, the sales reps who work out of Salesforce don’t have access to Zendesk for security reasons, so Workato will only sync comments that are not confidential. In Zendesk, you can mark a comment as public or private, and if it’s marked as private it will not be synced to Salesforce.

Zendesk Integration: Uploading Attachments to Comments using a File Sharing App

On some of the comments, Paysafe also needs to upload attachments to the Zendesk ticket, but they found the load time was too long. Workato will move the attachment to a file sharing app like Box and automatically provide a link as a comment in the thread itself, so users can download it more quickly.

“Zendesk has proven to be more than just a ticketing system for us and because of Workato, we can set up custom workflows and we can do certain things that Zendesk couldn’t do on its own,” concluded Jones.

Loved this workflow? Learn more about how you can automate Zendesk with Workato >