Originally featured on nasdaq.com here

Automating business processes and integrating different systems “to make them work together” is the Holy Grail of the IT industry. Over the past several decades user organizations have spent tens of billions of dollars to buy technologies that could help them automate business processes, exchange data across different business applications, and integrate with the processes of their business partners.

Despite all the investments accumulated so far, the automation and integration work user organizations will have to do over the next five years is likely to be more than the work they did over the past five. The obvious consequence is that investments in automation and integration technologies will have to grow. And quite substantially.

Automation and integration Technologies Will Play an Increasingly Crucial Role in User Organizations’ IT Strategy

Gone are the days when organizations bought most of their applications and systems (DBMSs, analytics tools, development tools etc.) from one vendor as an integrated suite.The transition to cloud has dramatically increased the number of best-of-breed (BoB) options that organizations expect to onboard to support their business processes. It is quite common for midsize organizations to have over a hundred applications in place and large organizations may have thousands. Mobile apps and, at least in certain industries, IoT devices keep surging and must be integrated with back-office business applications and analytical systems. Finally, the rapid growth in popularity of generative AI and other AI technologies, is creating a rapidly escalating demand for integration of these systems in organizations’ business processes.

This new world, where systems and devices proliferate, undoubtedly provides endless opportunities for innovation and differentiation, but also has implications from a business process perspective. In the old days of big ERP, HCM or CRM suites, processes were, by and large, rigidly “cast in code”, thus resulting as very hard to adapt to changing business requirements. In the new world the functionality of these processes are provided by a myriad of different, typically SaaS, applications. Therefore organizations must re-aggregate the end-to-end business processes by making all these different applications “work together”.

This might look as a major drawback of the BoB approach, in terms of costs, efforts and time, but it is not. BoB systems attractiveness is irresistible as they provide advanced and innovative functionality that the old monolithic suites could only dream of. Additionally, while re-constructing the processes, organizations have the opportunity to optimize, innovate and achieve an unprecedented level of business agility.

To help organizations address these issues, technology vendors have made available a variety of processes automation tools and application and data integration platforms. These collectively make up a market we call the Automation and Integration Technologies Market, which is already quite large and getting larger and larger.

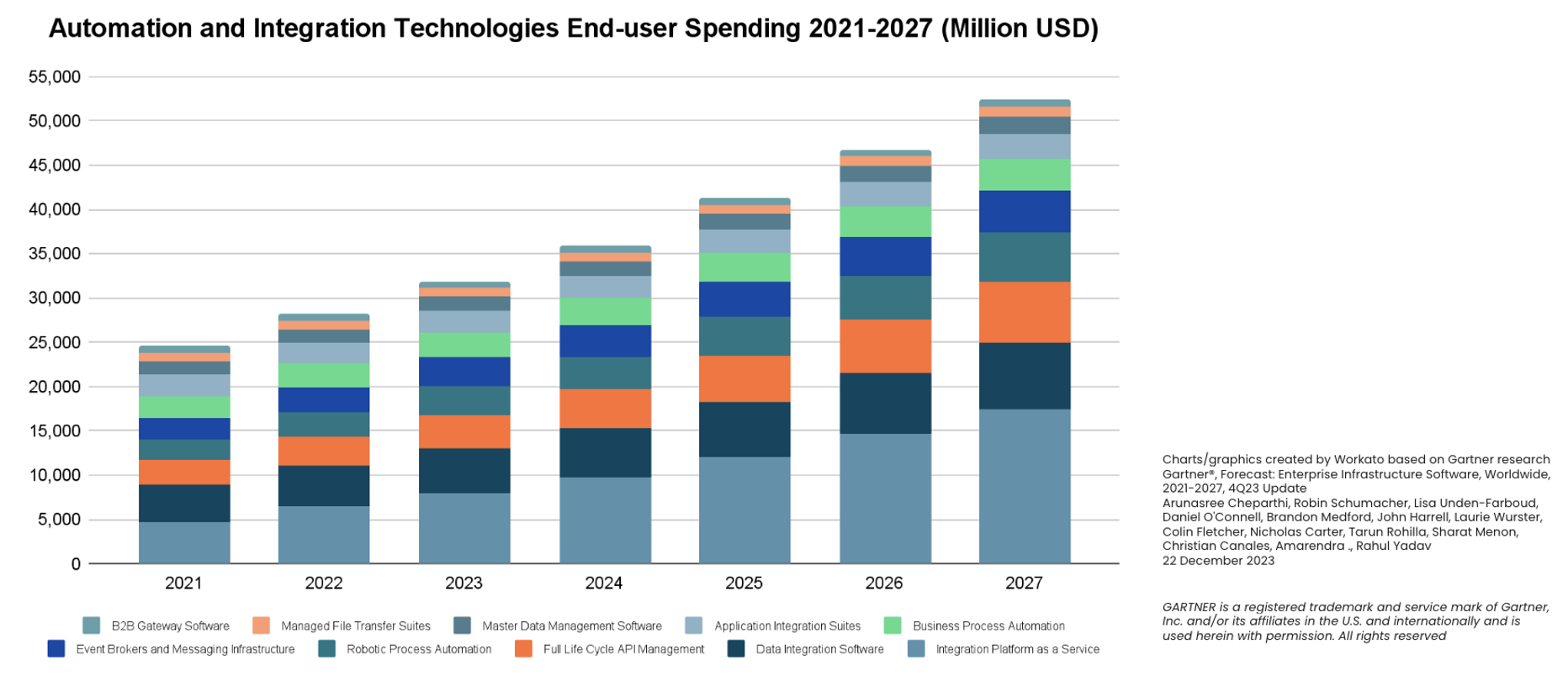

According to Gartner®, in 2022 user organizations spent approximately US$28 billion to buy automation and integration technologies and are expected to spend in excess of US$52 billion in 2027 (see figure 1).

Figure 1 – The Automation and Integration Technologies Market to Exceed US$52 Billion by 2027

This market consists of ten segments, each at a very different stage in the life cycle. Automation and integration technology became a significant, visible market in the late 1990s and since then it went through several waves of innovation and transformation. First generation segments – for example, managed file transfer (MFT), B2B gateway software and message queuing/pub/sub event-brokers – and second generation ones – for example, enterprise service buses (ESB – Gartner calls it application integration suite) and certain classes of data integration technologies (for example, ETL tools and MDM) – are technologically mature, products evolve very slowly, account for only a limited number of significant players and experience low single digit, or even declining, growth rates.

The current, “third generation” segments, which include integration platform as a service (iPaaS), API management platforms, robotic process automation (RPA) and event-streaming event brokers, came out over in the 2010s and are much healthier as they show a crowded and vibrant providers landscape and a solid, double digits growth.

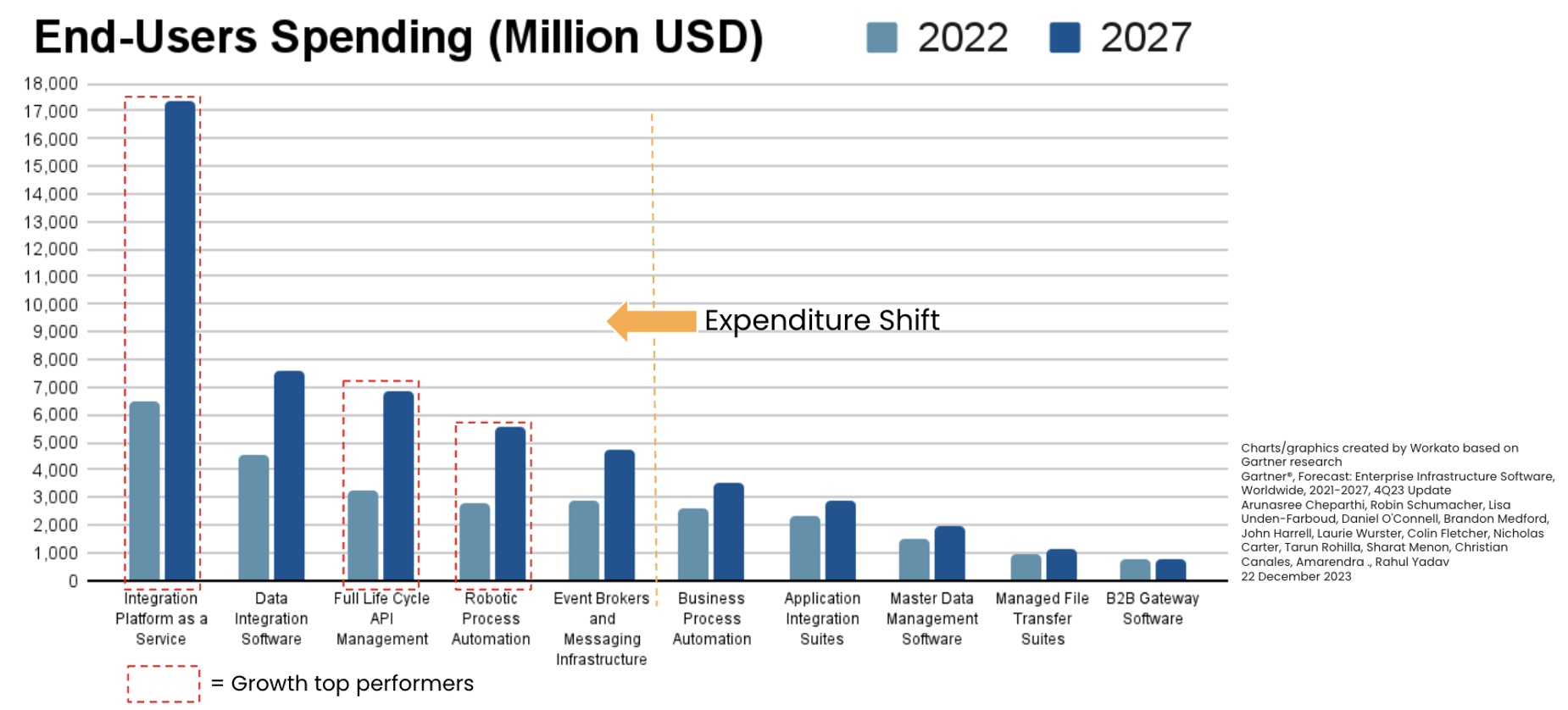

The market dynamic at play is quite clear: user organizations are mostly freezing their investments on the previous generation tools, limiting them to maintenance fees and incremental new licenses. Organizations are reorienting their focus on the new generation of tools: iPaaS, “modern” data integration, API management, RPA and event brokers. Of this “new generation” iPaaS, API management and RPA are the fastest growing segments, of which iPaaS is rapidly emerging as the 800-pound gorilla. iPaaS is expected to grow from about US$ 6.5 billion in 2022 to approximately US$ 17.4 billion in 2027. By then, according to our calculation, any other segment will account for only a fraction of iPaaS (see figure 2).

Figure 2 – iPaaS Dominates the Automation + Integration Technology Market

iPaaS: the Automation and Integration Swiss Army Knife

What are the reasons for iPaaS remarkable success? And why do analysts have such high expectations for its market growth?

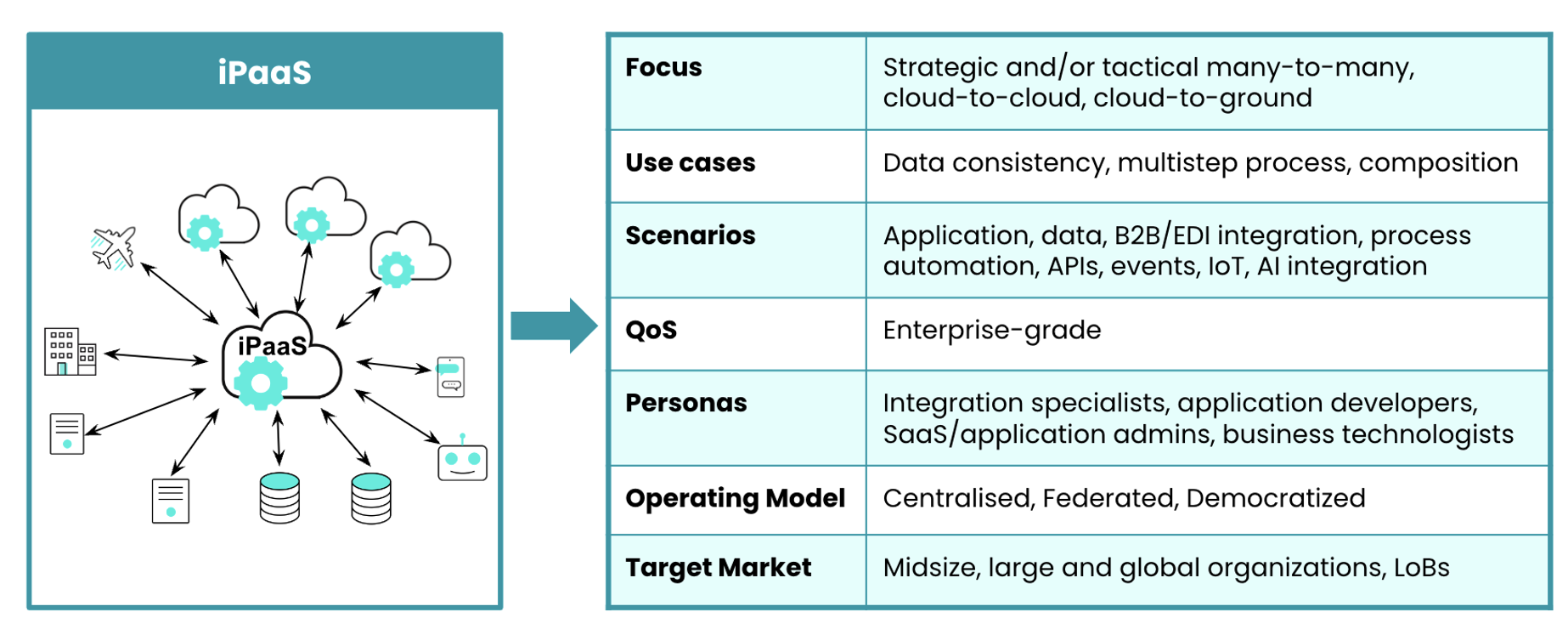

Formally an iPaaS consists of a combination of capabilities enabling organizations to develop, run and manage integration flows that connect applications, data sources, APIs, events and devices across hybrid, multi-cloud environments. By definition an iPaaS is delivered as a cloud service, although most providers also support hybrid deployment models.

A low code development environment is also a common iPaaS feature. The most advanced iPaaS offerings will soon complement this low code approach with generative AI-powered “copilots”, which enable developers to build automation and integration flows by expressing the desired outcome in natural language.

Organizations use iPaaS to implement a wide range of scenarios, including, but not limited to: synchronizing data across different applications, automating end-to-end business processes, connecting mobile apps with business applications, supporting API economy models and several others.

Simply put, an iPaaS provides, in the form of a cloud service, a combination of the functionality typically provided by a variety of first, second and also third generation technologies (see figure 3).

Figure 3 – iPaaS Functionality and Characteristics

There are many factors, contributing to the iPaaS market success, including:

- Growing amount of work. IT megatrends such as cloud, mobile, IoT, API, analytics and AI are generating high amounts of new automation and integration requirements.

- Cloud adoption. As organizations move to the cloud, adopting a cloud-based automation and integration platform makes a lot of sense from the architectural and technical standpoints.

- Unlike traditional platforms, typically focused on supporting a relatively narrow set of requirements (for example, data integration), organizations can use iPaaS to address a wide range of scenarios, such as application and data integration, process automation, partner integration, API publishing, event processing and AI integration.

- Support for a range of constituencies. In addition to integration engineers, thanks to their low code, AI-assisted development paradigm, many iPaaS offerings enable also application developers, SaaS administrators, business analysts and, in some cases, even business users to perform automation and integration work. This not only favors widespread adoption within organizations, but also by organizations with average or even low skilled workforces.

- Large addressable market. Most vendors have packaged and priced their iPaaS not only to appeal to large, deep-pocketed IT departments, but also to attract midsize organizations and LoBs, for which traditional platforms, such as ESBs or data integration tools, were simply prohibitive in terms of investments and skills.

The net-net is that iPaaS is not only eating market share away from traditional automation and integration tools, but is also fulfilling requirements and targeting constituencies that traditional tools could not address at all.

This trend will not stop as iPaaS will continue to absorb functionality from the other segments and address more and more emerging scenarios. One of them is AI integration, that is, infusing AI capabilities in organizations business processes to improve their efficiency and effectiveness. We expect that over the next five years, AI integration will emerge as one of the top three automation and integration scenarios from an effort and expenditure perspective.

AI will also play a critical role in the evolution of the iPaaS technology by enabling a quantum leap in IT and business developers productivity, by reducing operating costs and by improving quality of service (operability, availability, scalability, manageability, security and compliance). This will further increase iPaaS appeal, favor widespread diffusion within organizations, including from business teams, and further lower the cost and skills barriers to adoption.

What Should CIOs and IT Leaders Do?

iPaaS technology is clearly emerging as pivotal in user organizations, both large and small. Therefore CIOs and IT leaders are increasingly asking themselves what is the best way to approach this technology and put it at work for the benefit of their organization.

In our opinion, to successfully introduce iPaaS, they should:

- Adopt iPaaS with a strategic mindset. CIOs and IT leaders should position iPaaS as the cornerstone of their automation and integration strategy. In particular, an iPaaS likely provides the vast majority of the capabilities a midsize organization needs—both now and in the future.

- Plan for a coexistence with previous generation technologies. Organizations, especially large, usually already have in place a range of previous generations tools, as well as an API management platform and, possibly, a couple of “tactical” iPaaS in some business teams. CIOs and IT leaders should strategically plan for a complementary coexistence of the new strategic iPaaS with all these tools.

- Look for opportunities to replace “legacy” technologies. Not all the previous generations’ technologies are equally effective and viable. Some were originally designed 25-30 years ago when there was no cloud, no mobile, no APIs, no IoT, and no AI. Therefore they are not suitable to address the modern needs and requirements. Some of these old technologies are even reaching the end of their lifecycle and are heading towards end-of-support. The best way to replace them is often an iPaaS.

- Select an iPaaS that is future proof. Many iPaaS providers have been in the market for years, accumulated thousands of customers, and have been battle tested in hundreds of thousands of real-life scenarios. Most iPaaS are “good enough” for addressing the most classic needs. Though, not all are equally good at supporting the convergence of automation and integration, new scenarios such as AI integration, and AI-based support for business team developers.

No organization is or will be “immune” from automation and integration. However, this is not a disease to fight, but an opportunity to create business value in terms of efficiency, business agility and innovation. The technology options are many, but iPaaS is proving to be the cornerstone for virtually every organization’s automation and integration strategy.

Therefore, for CIOs and IT Leaders devising the best iPaaS strategy is not a matter of “if”. It’s a matter of “when”. But they should act quickly: given the fast market growth, chances are their competitors have already adopted or will soon adopt iPaaS. Dragging their feet wastes opportunities and risks putting their organization at a competitive disadvantage.

Figure 1 and 2 include charts/graphics created by Workato based on Gartner research

Gartner®, Forecast: Enterprise Infrastructure Software, Worldwide, 2021-2027, 4Q23 Update