Markets are more dynamic than ever. Businesses rely on finance responsiveness and safe innovation to keep up with rapid change. I recently presented with Mike Harrington, Finance Domain Expert at SuiteWorld, an annual gathering of the Netsuite community. I realized we needed to codify some of his deep learnings from 20 years working in technology to make finance organizations successful. The result was this ebook. Read on for some insights from our talk and the ebook to help you start building an autonomous finance function on top of NetSuite.

Today’s successful companies are either experiencing high growth or preparing for it. While growth is the end goal, it puts more strain on your people, processes, and technology. Like that, there are more contracts to review, more vendors to onboard, and more expense reports to pay. Overwhelming, to say the least. With over 20 years in the finance transformation space, dedicated to building best-of-breed finance systems, I’ve seen firsthand the harm operational bottlenecks can have on a company’s agility and bottom line.

Now, you might be tempted to address your business’s growing needs by hiring more and buying more software. That would be a mistake. Sooner or later, gaps will emerge, where buying your way out would be impractical and infeasible, not to mention expensive.

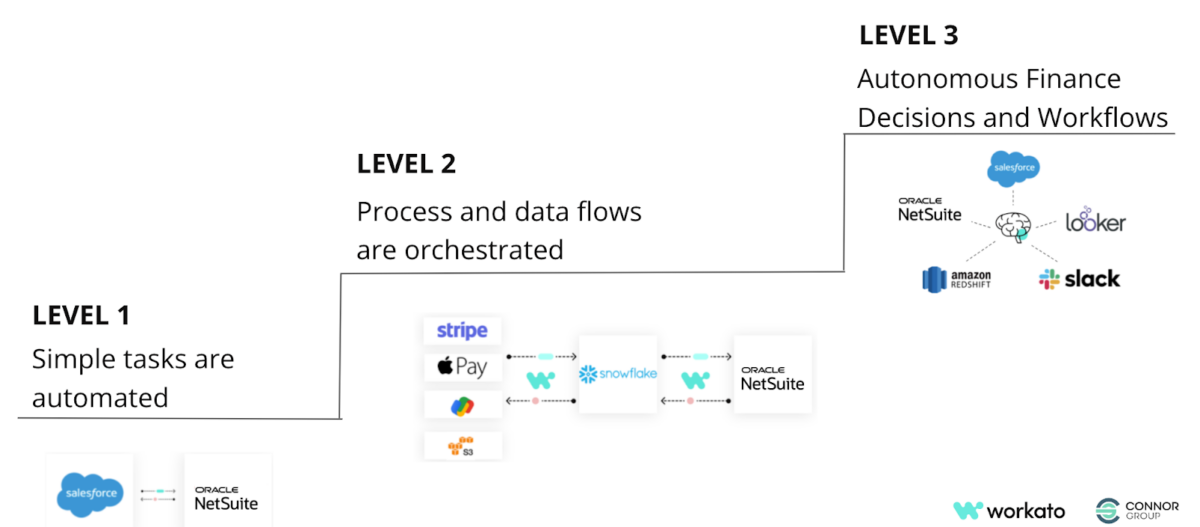

Automation is the only way to scale healthily. In my experience, the automation of a company’s finance function occurs in 3 levels, aligned with the vision of Jason Pikoos, Managing Partner of Client Experience at the Connor Group.

Every company beginning its automation journey starts at Level 1. At this stage, automation tackles repetitive and time-intensive tasks to save hundreds or thousands of hours a year. An example of a Level 1 project would be establishing an essential integration between Salesforce CRM and Netsuite ERP.

As companies ascend to Level 2, they explore use cases for deeper orchestration that offer real-time reporting and effective modeling. One such use case is syncing data with both payment processing systems and cloud storage in a data warehouse, such as Snowflake.

Finally, we reached Level 3. Level 3, or autonomous finance, is where everyone heads in the long run. It is a collection of systems and workflows that can act self-sufficiently by leveraging artificial intelligence and machine learning.

It’s important to mention that each level of this framework builds to the next one and that value is to be gained at each step. Automating repetitive tasks at Level 1 removes the risk inherent in manual steps. The end-to-end orchestration indicative of Level 2 can shorten time-intensive processes such as closing the books and processing contracts. As a sweetener, the data generated in Level 1 and Level 2 automation can enhance the quality of your source system, creating a foundation of reliability that can catapult you into autonomous finance.

This journey cannot be made overnight and requires a step-by-step approach tailored to each company. But the rewards are well worth it. Now more than ever, finance functions must keep up with the strategic ambition of the enterprise. So don’t just keep up— get ahead. Download our exclusive, hot-off-the-press eBook, “Build Autonomous Finance Operations on Netsuite,” to learn more about how companies like Malwarebytes, Seatgeek, and Atlassian save thousands of hours yearly.

What’s inside:

- Step-by-step guide on integrating NetSuite and Salesforce for seamless, real-time data synchronization.

- Proven strategies to automate critical finance workflows like order-to-cash, cost center orchestration and bank reconciliation processes.

- Real-world examples and case studies from leading companies help you visualize automation’s impact at every level.

Download the eBook now and start building a finance function that scales effortlessly with your growth!