When it comes to managing customer data, financial data, and other key business information, your CRM and ERP tools are indispensable.

This is exemplified by the fact that over 90% of organizations with 11 or more employees use a CRM; and it explains why the market for ERP systems is projected to exceed $49.5 billion dollars in just a few years.

But to make full use of both platforms and to ensure that your most critical business processes operate effectively, you’ll need to integrate the two technologies.

We’ll break down why that is by highlighting several examples, but before we get into them, let’s briefly recap each system.

How to level up your O2C process

The 4 levels in our O2C model can help you benchmark your process and identify areas for improvement.

CRM and ERP tools defined

Simply put, a customer relationship management platform is a type of software that helps employees manage their relationships with prospects and clients.

It’s often used by employees who work in sales, support, marketing, and customer success; where each team can use the platform to find key information on clients and prospects, add info (e.g. contact information or a note on a recent customer interaction), upload files, build reports or dashboards, take actions (e.g. sending emails), etc.

An enterprise resource planning system, on the other hand, is a type of software that allows organizations to perform a variety of day-to-day tasks, most of which fall under finance. This includes any activities in accounting, procurement, risk management, and supply chain management.

Related: The ultimate guide to CRM integration

What is CRM-ERP integration?

Simply put, it’s when your ERP and CRM systems are connected, typically by their application programming interfaces (APIs). This allows you to keep the two systems in sync, as well as build automations that work across them and other applications.

Common integration use cases

Here are just 3 examples that illustrate the value of connecting these apps, both for your sales team and your employees in finance.

1. Sync cases to make sales aware of issues

Unfortunately, once a client signs on, a variety of issues can crop up. Perhaps most notably, the client delays their first invoice payment.

When the latter happens, your employees in accounts receivable can notify the appropriate sales rep and enlist their help in tracking down the payment. All they’d do is create a case in their ERP system that outlines the issue. A corresponding case then gets created for the client in your CRM software—where sales can uncover the issue.

Related: Everything you need to know about ERP integration

2. Sync sales orders to process deals faster

To help your accounts receivable team move quickly in invoicing the client, you can instantly create the sales order in your ERP software once the sales rep adds it in your CRM system. And if the new client doesn’t yet exist in your ERP software? Your workflow can create the client before adding the sales order to their account.

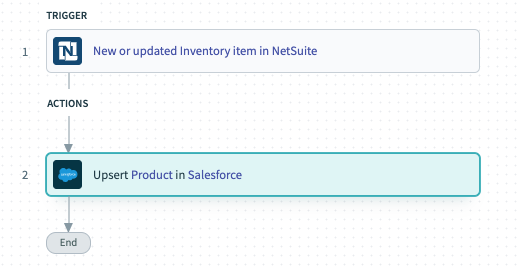

3. Sync product inventory updates so that reps can sell with confidence

To prevent your reps from disappointing clients and losing sales, you can let them know which products are available at any point in time. This simply involves synchronizing the product inventory between your ERP and CRM system in a way that accounts for new products becoming available as well as changes to the inventory of existing products.

Benefits of ERP and CRM integration

At a high level, ERP and CRM integration helps eliminate data silos between sales and finance; it allows your employees to (more easily) avoid human errors; and it enables sales reps and accounts receivable specialists to focus on more strategic, business-critical work.

Let’s take a closer look at these benefits, in addition to others.

Eliminate data silos

Data silos, simply put, is when data is locked in specific applications—preventing employees who can’t access those apps from leveraging the data. In the context of CRM and ERP applications being siloed, this can lead to sales reps or employees in finance requesting data from one another, or (worse) to simply be unaware that certain data exists.

By connecting the two systems and allowing the data to flow between them seamlessly, these silos are inherently stripped away—along with the negative consequences they once created.

Prevent costly mistakes

When the applications operate independently, employees are forced to manually re-enter data from one to the other. This task is prone to errors, and many of these errors can lead to significant harm for your business. This can take the form of a sales order getting added to the wrong client in your ERP, a case getting created for the wrong client in your CRM, the incorrect product inventory being updated in your CRM, etc.

Syncing the data between the apps allows your team to avoid data entry, which all but ensures that the data in your CRM and ERP is kept accurate and up to date.

Lift employee productivity

Once employees in sales and finance can avoid the time-intensive task of hopping between apps and inputting duplicate data manually, they can focus more of their time on the strategic, business-critical work they’re more likely to value.

For sales reps, this can mean crafting more personalized emails to warm leads, and ideating strategies for re-engaging prospects who’ve gone cold; while for employees in accounts receivable, this can be responding to billing questions from key clients faster and more thoughtfully, as well as crafting reports that help management make more informed decisions.

Increase sales

Since integrating your CRM and ERP largely eliminates manual and tedious work for your sales reps, they can focus more on the activities that allow them to close deals. In doing so, you’ll also give your organization a competitive advantage, as the average rep spends a meager 34% of their time selling.

Optimize order fulfillment

The order fulfillment process likely requires close collaboration between your sales, finance, and operations teams. To support their collaborative efforts, you can sync your sales forecasts from your CRM with your ERP system. That way, your operations and finance teams can better manage inventory and allocate resources appropriately over time (e.g. employing a certain number of employees in the data warehouse over a given week). In addition, by syncing the order status between the two systems, your sales reps can easily track orders and provide accurate updates to clients when necessary.

Provide selling guardrails

Critical product information likely lives inside your ERP system, which includes a product’s availability and the price (or price range) that’s assigned to it.

Integrating your CRM and ERP system allows this information to become readily available to sales reps, all but ensuring that they’re only offering products that are in stock (or that will become available soon) and that they sell each at the right price point.

Challenges in integrating your CRM and ERP

Despite these benefits, there are a variety of roadblocks that prevent your team from integrating the two systems quickly and successfully.

1. Connectivity issues with a legacy ERP system

Your system may not offer an API as a means of connectivity, and while there are other integration options—such as using a database connector that can export data from the legacy ERP system into the CRM, or using files to import and export data between the two systems—, each come with their own drawbacks.

2. Many integration solutions fail to meet requirements

Your organization has a variety of integration options at its disposal, from using an integration platform as a service (iPaaS) to using native integrations to implementing point-to-point integrations.

However, each comes with its own set of disadvantages. Point-to-point integrations are often time consuming to implement and maintain; native integrations offer limited functionality and likely fall short of your business requirements; and an iPaaS still requires expertise to use, which prevents your organization from implementing integrations quickly and at scale.

3. Integration may not be enough

Your organization likely uses your CRM and ERP system for a variety of key processes, with the most notable example being quote to cash.

To truly transform these processes so that they operate in a way that’s resilient, scalable, and efficient, you’ll need to build workflow automations that can work off of business events (or triggers); once triggered, real-time business outcomes (or actions) should then take place across your CRM, ERP (among other apps), data, and teams.

Transform your go-to-market processes end-to-end with Workato

Workato, the the leader in enterprise automation, offers a low-code/no-code platform that addresses all of the integration challenges highlighted above. In addition, it offers:

- Hundreds of thousands of pre-built automation templates and more than a thousand pre-built application and database connectors, allowing you to connect your systems and streamline your workflows both quickly and effectively

- Workbot®, a customizable platform bot that lets you bring automations to your business communications platform, whether that’s Slack or Microsoft Teams

- Enterprise-grade security and governance via features like role-based access control and activity audit logs