With Automate 2024–Workato’s annual customer conference–behind us it’s time to share the top stories to inspire IT teams to embrace the speed and power they need to execute on their most strategic projects. Projects like major implementations, migrations, and ongoing optimizations to move the needle for their businesses. This story centers on the Atlassian Intelligent Automation Platform and FinTech Team, and how Daivish Shah, Varad Seshadri & Mounika Raj successfully accelerated their ERP migration as a team. This journey transformed their financial operations while setting a new benchmark for efficiency and innovation in enterprise IT projects.

“We’ve reduced ERP tech debt by 98%, cutting down from over 800 scripts to just 15. Fiscal closures are now 63% faster, shrinking from 8 days to only 3 for us.”

– Daivish Shah, Intelligent Automation Platform Architect at Atlassian

Journey From a Legacy iPaaS to Workato’s Modern Platform

Daivish joined Atlassian in December 2018 as their first Senior Integration Engineer, bringing with him a wealth of experience from Tesla, where he built a billing engine from scratch. Since joining, Daivish has been instrumental in achieving all its finance integration milestones, particularly in the FinTech domain. Their integration efforts began with a legacy solution in 2016, and by 2022 they began transitioning to Workato to orchestrate automation across complex workflows, apps, and systems with plans for a full replacement. Moving off of the legacy iPaaS was crucial as they needed something more flexible and scalable to support their ERP migration from NetSuite to Oracle Fusion to meet the needs of their $10B business.

This was a key milestone for how Workato could support their objectives, offering better integration, enhanced automation, and improved financial reporting.

Project POLY: Climbing the Olympus Mountain

Their ERP migration project, aptly named Project POLY after the challenging Olympus Mountain, was no small feat. They faced multiple external vendor dependencies and navigated through over 800 NetSuite customizations. Despite these challenges, they developed data engineering pipes for seamless data flow and implemented a new chart of accounts to enhance financial reporting features. They went live in October 2023, closing the fiscal year in Fusion within an aggressive timeline of just nine months. This success was achieved through meticulous User Acceptance Testing (UAT), efficient cutover management, and a focus on performance optimization.

Remarkable Achievements in Just Nine Months

The numbers speak for themselves. In just nine months, they tackled over 1,000 business requirements, managed a project team of more than 250 members, tested over 2,800 ERP use cases, executed more than 2,000 cutover activities, and developed and delivered 73+ Workato integrations. These achievements were made possible by ensuring the right governance controls were in place for go-live purposes.

Overcoming Challenges with Robust Planning

The journey wasn’t without its challenges. They had to manage an aggressive timeline, navigate integration complexities, allocate resources effectively, mitigate risks, and re-engineer business processes. To tackle these, they employed several robust planning strategies, including conducting a comprehensive assessment of the ERP migration, establishing a consistent team assembly cadence, managing stakeholders effectively, and applying strong solution design principles. Their clear ERP migration goals focused on achieving operational excellence, enhancing cost efficiency, ensuring scalability, meeting the September 2023 go-live deadline, and staying committed to the budget.

Why Workato?

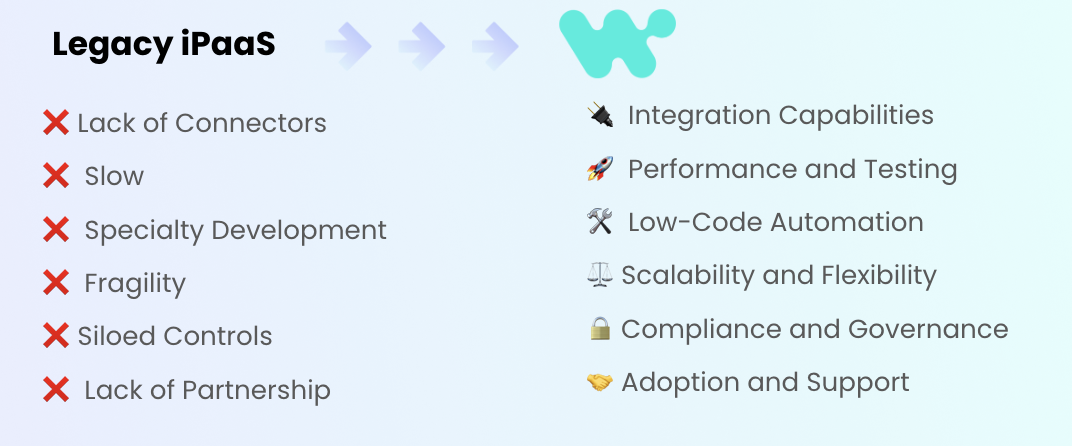

Their decision to transition from their legacy iPaaS to Workato was driven by several compelling reasons. The legacy platform had significant limitations: a lack of connectors, slow development cycles, the need for highly specialized development resources, fragility, siloed controls, and a lack of partnership opportunities to innovate and introduce new features. Workato addressed these challenges effectively. One standout example is their collaboration with Workato to develop a new Oracle Fusion connector, tailored specifically for Project Poly, enabling seamless integration with EA. Workato also supported the development of other crucial components, such as performance testing, unit testing, and low-code automation, all while ensuring scalability, compliance, and governance.

Key Metrics and Broader Use of Workato

They oversee the development lifecycle across three distinct Workato instances: Development, Staging, and Production. In their production environment alone, they have over 2,000 active recipes, processing around 886.7 million transactions annually. This scale of usage demonstrates how Workato meets the needs of its $10B business. Additionally, they have a wealth of other important metrics available, providing a quick and comprehensive overview of Workato’s significant footprint at Atlassian.

Finance Optimization Use Cases

Within their finance integrations, notable use cases include the integration of AP invoices and credits for Coupa, Fieldglass, and Concur, the extraction of General Ledger (GL) balance sheet data, and payment reconciliation with Blackline. They also managed the integration of corporate card bills and accrual journals from Concur. On the master data side, they successfully synced critical data such as products, departments, accounts, currency, and location masters, as well as the synchronization of new accounts with Blackline. They addressed discontinued and special cases, such as processing payment acknowledgments for Concur and Coupa bills and updating invoice installments with new bank details. In reporting and reconciliation, they achieved integrations from Fusion to Blackline for various financial reports, Fieldglass to Blackline for invoice uploads, and Concur for corporate card journals and bill extraction. For payroll and HR integrations, they connected Workday to Fusion for employee and payroll journals and integrated SailPoint with Fusion for person management. These are just a few of the examples of how Daivish and his team leveraged Workato to not only streamline the migration process but also to unlock tremendous efficiencies for the finance organization.

Significant Outcomes and Future Prospects

In closing, I’d like to highlight some significant outcomes they achieved with Workato. Our ERP migration was 40% faster, saving 67,000 hours across the finance organization. Process acceleration was notable, with customer data refresh times improving by 90%—down from 5 minutes to just 30 seconds—and invoice status validation speeding up by 87%, now taking only 2 minutes instead of 15. Additionally, there was a remarkable reduction in both time and technical debt.

These outcomes underscore’s Workato’s transformative power in driving efficiency, innovation, and growth. For enterprise architects and business technology automation experts, Workato is not just a tool for major implementations and migrations but a comprehensive platform that supports all IT projects. By leveraging Workato, you can future-proof your strategy and operations, ensuring your organization remains agile, responsive, and ahead of the curve in an ever-evolving business landscape.

Join us in embracing the future of enterprise orchestration with Workato, and experience firsthand how it can revolutionize your business processes, just as it has for Atlassian.