The Air Force Association (AFA) is an independent nonprofit that provides career, financial, health, legal, and other services to over 120,000 current and former USAF members in 49 states. The organization also works to educate the public on aerospace’s role in a strong national defense.

The Board of Directors for the AFA were frustrated with the limited visibility they had into the organization’s finances—they wanted to know where millions of dollars were coming from and how it was being used to benefit their members. Trying to provide this information was a real pain point for the organization, because financial reports took over a month to compile. The Board of Directors wanted to know why it took over a month to get up to date financials, and the AFA wanted to update their technology and processes to address this issue.

Transitioning to a Cloud-Based Strategy Reveals a Need for Automation

To help modernize its operations and solve their reporting problem, AFA first replaced their older technology with cloud-based apps. These apps include Fonteva Membership—which is built on Salesforce—for member services and Sage Intacct for accounting.

Although switching to cloud-based solutions was a step in the right direction, it didn’t fully solve the reporting problem. Financial data now lives in two separate apps, and it had to be reconciled and synced before the accounting team could generate an accurate report.

Moving the data manually was a daunting prospect. Because of the sheer volume of records and the overall complexity of AFA’s accounting, it would take too much effort and would be too error-prone. The team needed a better approach—one that could speed up the reporting process and eliminate manual data entry.

Connecting Salesforce and Intacct with Intelligent Automation

When AFA teamed up with Venn Technology to find a solution, they recommended using Workato to help AFA integrate its new cloud apps and automate the process of reconciling financial data.

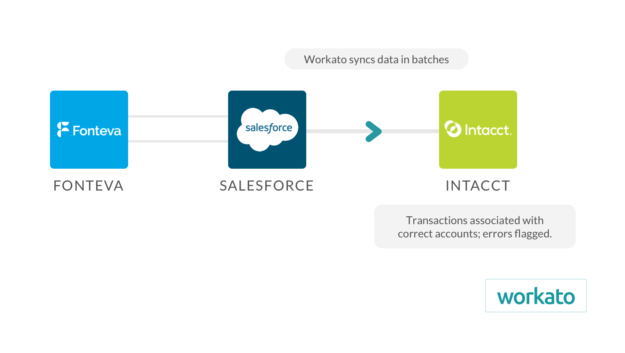

With Workato, transactions are now seamlessly synced between Salesforce and Intacct on a nightly basis. These transactions are also automatically assigned the correct code in Intacct’s general ledger, properly segmented, and associated with the right account. Errors are automatically flagged and reported for easy follow-up. As Venn Technology puts it, the AFA is now cruising on auto-pilot!

1 Million+ Records, $MMs Processed, 451 Batch Entries to GL in 5 Months and Zero Manual Operations

Salesforce automation and integration have drastically simplified AFA’s accounting operations. The month-end close, for example, has been shortened by ten days. That’s a huge savings, both in terms of efficiency and in terms of staff hours. Over the past five months, in fact, AFA has automatically synced and reconciled over one million records in 451 batches, thanks to Salesforce automation!

Additionally, data is now always accurate and up-to-date; the organization’s leadership, which used to wait up to a month for financial reports, can see accurate data right away—with zero manual operations. As AFA’s CFO, Joseph Stangl, puts it: “Now we have up-to-date numbers every day. When the finance team walks into work, they can get the numbers while still drinking their first cup of coffee!”