Your organization’s ability to collect/make payments, stay compliant, and provide real-time reporting, largely depends on how you use your ERP, NetSuite.

How can you use NetSuite to perform any finance-related task successfully? By building finance automations around the platform.

To that end, here are 3 NetSuite automations that you should focus on implementing first!

1. Procure-to-Pay Automation

When performed without automation, your procurement process is far from perfect. Here are two pervasive issues:

- There’s a long turnaround time for signing your purchase order.

You’ll often need to get the purchase order reviewed by several colleagues, from your manager to the head of your department to someone in finance.

Throughout your approval process, there’s likely to be at least one colleague, if not more, who forgets to review it. This not only forces you to constantly nudge them to sign it, but it also prevents you from getting it completed promptly.

- There’s a high chance that your invoices are filled with errors.

When your colleagues fill out invoices manually, they might accidentally make costly mistakes, such as putting inaccurate billing information.

Any invoice-related issue can delay your employees from getting a product or service they need to be productive, and it can hurt your organization’s relationship with the vendor.

You can prevent either procure-to-pay issues from taking place by using automation.

For example, once the purchase order is generated in NetSuite, you can use Workbot (our enterprise platform bot) to request the appropriate stakeholders to review it via a chat platform, like Slack. If any stakeholder doesn’t sign it within a certain amount of time, Workbot can remind them to do so.

You can also integrate NetSuite with a platform like Coupa; once integrated, you can build a workflow where once an invoice comes into Coupa, an accurate, ready-to-be-processed vendor bill is automatically generated in NetSuite.

Related: How to automate your AP process

2. Quote-to-Cash Automation

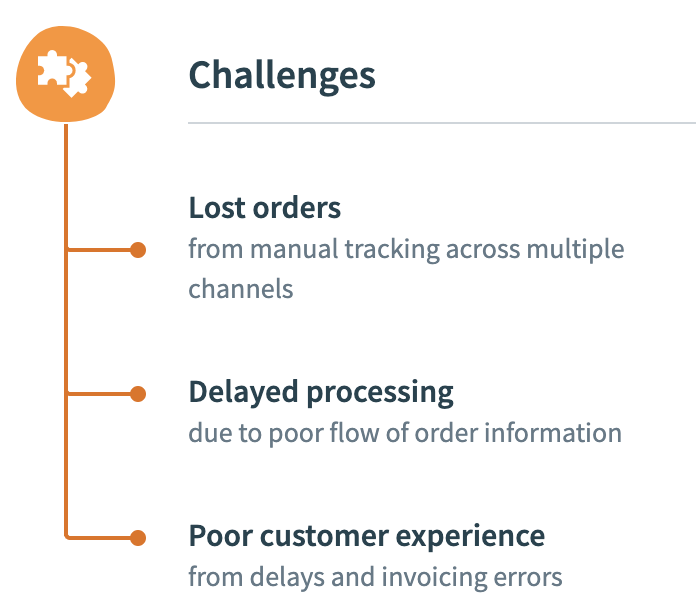

Your organization’s ability to collect payments quickly and with little manual effort is paramount to its growth. But like procure-to-pay, your quote-to-cash process might be vulnerable to a variety of issues:

You can avoid these challenges altogether by connecting NetSuite with a CRM like Salesforce and then building out the following workflow automation:

- Once an opportunity in Salesforce is marked as “Closed Won,” the workflow gets triggered.

- The products from the Salesforce opportunity as well as general details from the account get added to NetSuite.

- NetSuite creates a sales order that includes all of the relevant details.

- Once the order is fulfilled, the account in Salesforce gets updated.

Related: 3 quote-to-cash apps that can help your sales reps excel

3. Compliance and Risk Management Automation

As an employer, there’s an ever growing list of things you need to do to stay compliant.

You can stay compliant with minimal effort by turning to automation. For example, you can connect NetSuite, along with other apps that collect important documents, with Box. From there, you can build a workflow that takes all of the important documents you add or edit across your apps, and instantly add or edit them in Box.

Once you begin to use the workflow, it becomes all the more easy to retrieve the documents you need, when you need them, as they’ll live in files within Box.

Want to learn more about these NetSuite automations? Schedule a demo with one of our automation experts to see them in action!