Industry surveys—surveys of a particular field—are a valuable tool for any enterprise. They can help you gain insight into your field, hone your product to meet customer needs, and identify emerging trends. They can even become great pieces of marketing collateral when you publish the results in a compelling industry report. Traditionally, research and consulting firms like McKinsey, Gartner, and Forrester created industry surveys. But today, lots of SaaS companies do their own surveys as well, because they can be such a valuable tool. If you’re not a professional research analyst or statistician, though, creating a solid survey can seem insurmountably challenging. Thanks to tools like SurveyMonkey, implementation is a lot easier. But before you open an app and start writing survey questions, ask yourself these ten questions.

1) Why do I want to do this survey?

People often think about creating a survey without really knowing what they want to find out from that survey. Do you want to track industry trends? Do you want to get feedback on an idea? Coming up with a list of objectives should always be the first step.

Beyond thinking of goals for the survey, you should also give some thought to what you want to do with the information once you get it. Are you looking to compile and distribute a long-form report with the data? Do you want to use the information internally? These questions are crucial to shaping a successful survey.

2) Whom do I want to hear from?

Information gathered from a survey is only as good as the people you get it from. If you want to understand whether CIOs face a problem that your product could solve, you’ll need to come up with a way to target CIOs so that all of your answers don’t come from random entry-level employees. Whether you’re doing a study of your customers, C-suite execs, or the general industry population, make sure you understand why and how to best reach them.

A simple way to do this, for example, is to add screening questions to the beginning of your survey, to rule out less-than-ideal respondents. And if you buy a sample list of respondents, you can ask the list provider to target specific demographics.

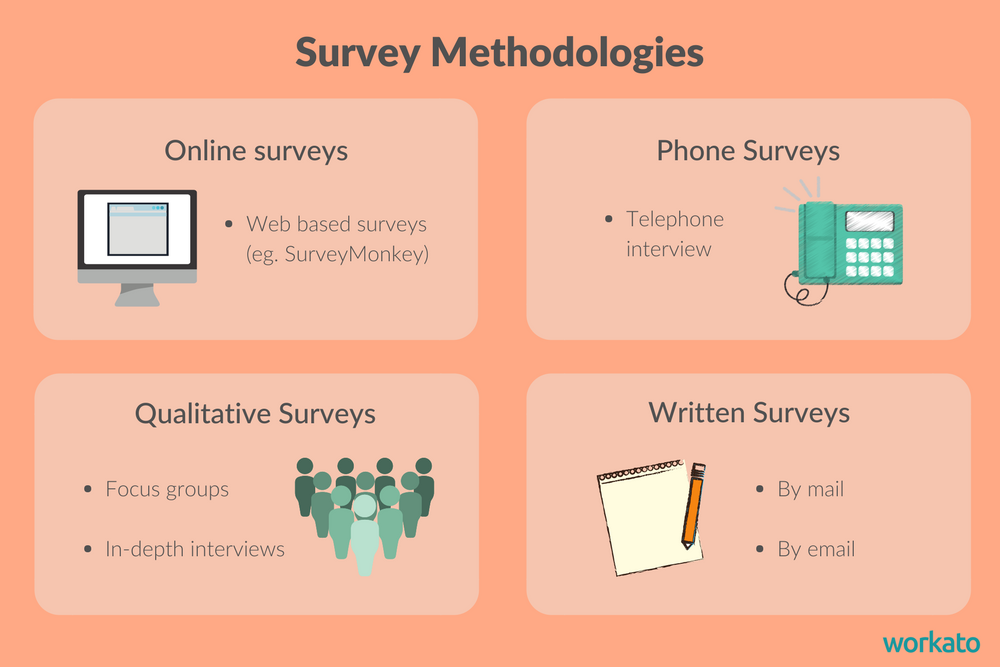

3) What kind of methodology will suit my needs best?

Online surveys are cheap and easy, but won’t necessarily give you representative results; similarly, though sharing your survey on Facebook will get you results quickly, they probably won’t be quality results. Phone surveys with random digit dialing can be representative, but they are very expensive and can take a long time. Qualitative methods like focus groups and in-depth interviews can give you high-quality feedback, but will only be hearing from a small group of people. In other words, each methodology has its own strengths and weaknesses. Be sure to choose methodologies that work best for the survey goals you set!

When writing a survey, your job is to make it easy—and as enjoyable as possible—to complete. Share on XNow you should be in a good position to start working on the survey itself—but first, ask yourself:

5) What kind of questions do I need answered?

We all would like to get what we want in a survey, but sometimes we have to be satisfied with getting what we need. Remember those objectives you set? Every single question should match up with at least one of your objectives.

Otherwise, if you include every interesting question you draft into the survey, you’ll wind up with a long, bloated mess of questions that no one will take the time to complete. And on that note, be sure to ask yourself:

6) Are people going to actually take my survey? Why?

Remember that a survey, at its core, is asking other people for their time to help you. When writing a survey, your job is to make it easy—and as enjoyable as possible—to complete. Always thank people for agreeing to help! If you want to help persuade people to give you their time, it always helps to offer them an incentive. Maybe that incentive comes in the form of cash, swag, or the chance to win a prize—whatever it is, it should encourage prospective respondents to complete your survey. When we created an industry survey here at Workato, for example, we donated $5 to hurricane relief in Puerto Rico for each response we received.

7) Are my questions clear and specific?

The data you collect is useless unless you know exactly what it means. With that principle in mind, it’s okay to ask open-ended questions—as long as you are okay with open-ended responses.

Try to avoid questions that ask more than one thing, because they can be difficult to get good answers from. For example, “Do you like PCs and Macs?” is a difficult question to answer; what if the respondent likes only Macs?

Similarly, overly broad and unspecific questions—such as “What technology do you use?”—could refer to anything. Make sure your questions are as specific as possible while making sure that the average survey-taker will know exactly what you mean. There are lots of online resources that can help you find effective wording for questions, as well as common survey components like demographic questions.

8) How will I report on the information I collect?

Will you be doing a press release? A detailed research report delivered to your CEO? A summary sent to your marketing partners? What you plan to do with the survey data influences the way you process that data—as well as what partner you work with, if any. If you only want to report on a couple key numbers (like the percentage of people who love a certain product), a superficial summary may suffice. But if you’ll be mining the data for strategic insights into demographic communities, you’ll probably want professionally-created data tables.

Both Bluewolf and Zendesk, for example, create annual reports with data from their surveys. These reports are beautifully designed, intuitively arranged, and—best of all—available for free to their customers and partners. Other companies might choose to make bite-size infographics for social media or use the stats to refocus their marketing efforts.

9) What kinds of data analysis do I need to do?

Depending on your objectives, you might only need a few summary points. If you want to compare different groups, though, you’ll need to create cross-tables, which can show answers across different demographics. And if you need more complex analysis performed, like factor analysis or cluster analysis, you’ll need the appropriate data files, software, and people with the right expertise. It’s important to plan for this beforehand, so you’re not stuck with mountains of good data that you don’t have the tools to understand!

10) Am I being honest with how I present the results?

Honesty is a core part of research. Apart from your legal, ethical, and fiduciary responsibilities, you have an obligation to be honest to everyone who reads your results—especially if you want to use this survey as a tool to gain credibility as an industry expert. Survey research is an important tool, and you betray both yourself and the people who rely on it if you succumb to the pressure of fudging numbers or only selectively showing one side of the story. There are always a million different ways to interpret a data point, but sometimes a bad story is a bad story, and you don’t help anyone by hiding that. That applies to methodology too; always make sure you honestly report on where you collected your data and how you did it.

And, finally, the most important question of all:

11) Am I having fun?

Creating surveys should be fun! Enjoy the experience as much as you can.